True Money Earning Apps

- True Money Earning Apps 2020

- True Money Earning Apps

- Money Earning Apps For Android

- Money Earning Apps For Android

- Money Earning App Download

- True Money Earning Apps Reviews

- What Are The Best Money Earning Apps

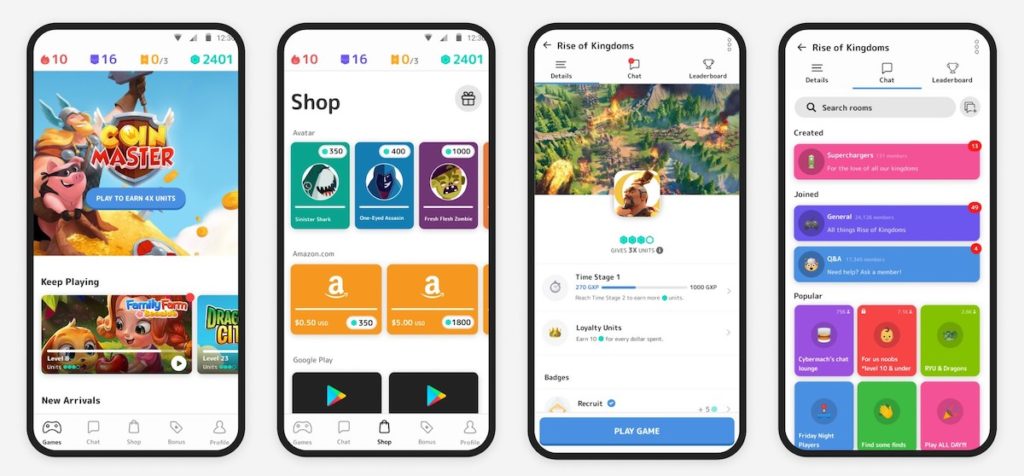

GiftPanda is one of the most highly-rated apps with 4.7/5 stars and 300000 reviews. You earn a lot of money for playing games, taking part in quizzes, getting achievement batches, referrals and a lot more. 6) CashOut CashOut is on the top charts as players love playing the amazing game. The real money virtual economy game. The money earned in the game be converted into real cash. Corporation master tests your managerial and business skills. Virtual currency is earned by doing this like starting a company, become an investor and by working every day.

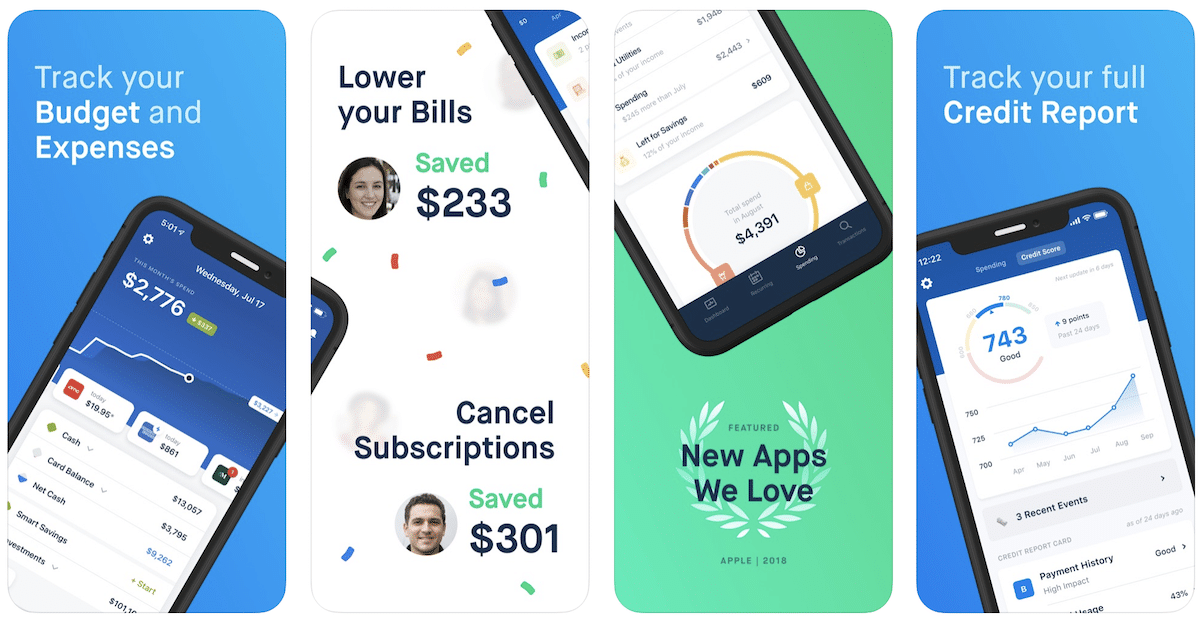

We all need a loan at some point in time. Whether it is for a planned expense, an unexpected indulgence or an emergency, consider a loan via a borrow money app. Apps that loan you money are great for bridging cash flow gaps. Loans can also help to finance the purchase of a large, expensive item that you can’t otherwise afford.

- This is an app that allows you to make money by taking photos. You can charge as much as you like per photo, which means that your money-making opportunities through Foap are virtually limitless. People are always looking for a huge variety of photos, and you may be surprised at how much money you can make with a photo of your cat.

- This is one of the better best passive income apps mentioned here, earning you extra money on shopping without the extra time. The best way to earn with this cashback app is to only shop at stores you would normally. Some people find that the incentive for earning cashback influences them to purchase things they wouldn’t normally buy.

Top Cash apps

PockBox

PockBox is the perfect app to get cash advances of up to $2,500 in minutes. The process is sleek and straightforward. You will just have to give some information about yourself.

The PockBox app should then connect you to the best lender possible and approve you in a matter of minutes.

SpotMe

If you’re looking for ways to get a fee-free cash advance (up to $100*) before your next paycheck, you should definitely try SpotMe by Chime. Chime is essentially a new type of banking service app.

Once you sign up, you get a free checking account with lots of goodies. There are no overdraft fees at all (in a matter of fact, you actually don’t have any fees whatsoever!) This service is called SpotMe and allows eligible members to overdraw up to $100* on debit card purchases without charging a fee. If you try to spend more than you are allowed after this, your transaction will simply be declined.

They also offer interest-free cash advances on your paychecks up to 2 days early with direct deposit**.

The best part is that the sign up process is really quick and easy (less than 2 minutes). Click here to check it out.

True Money Earning Apps 2020

Download money app

Taking out a loan with a money app is straightforward and you can often do it from your mobile phone or tablet. Some apps have a website too. These are the steps:

- Find and download your app. Go to your device app store – Google Play for Android devices and the Apple App Store for iOS devices such as an iPhone. Search for the app you want to use and download it to your phone, installing it when the download is complete. Note that some apps are only accessible via the app’s website.

- Complete your personal details. Every app will require your basic details including your full name, email address and often your physical address and phone number.

- Provide further information. Some apps will require further information. Earnin, for example, requires proof of your income. FasterFunds will require your social security number. Each app has slightly different requirements.

- Connect your bank account. Both MoneyLion and Dave are examples of apps which require you to connect your bank account before you can get your funds. Often connecting your bank account also means the app automatically deducts repayments from your bank balance.

- Ensure you make your payments. Repaying your loan in line with the repayment schedule you agreed to is important. For apps that automatically take repayments, you need to make sure you always have the funds available. Some loans are repaid manually, set a calendar reminder for yourself to make sure you don’t miss any payments.

More on Personal loan apps

App to borrow money

You are spoiled for options if you need to borrow, money apps come in all shapes and sizes. Each app is slightly different in the way it works and you just need to find the app that meets your individual requirements. These are some of the apps we think you should take a look at:

- PockBox app. With the PockBox.com app, you get access to amounts from $100 to $2,500. It’s ideal if you are short in cash until your next paycheck but it’s the not the type of money you need for a bigger goal. The process of getting the loan is quite sleek – just make sure to read all the conditions.

- MoneyLion Plus app. You qualify for loans with MoneyLion by subscribing to the combined loans and investment product called MoneyLion Plus. With MoneyLion Plus you can borrow up to $500 without as much as a credit check. Note that MoneyLion Plus is an ongoing subscription service, and you will need to continue your subscription for as long as you have an outstanding loan.

- Dave app. With Dave, you can easily borrow small amounts of $25, $50 and $75. It acts like an overdraft protection but without the associated fees. The Dave app is easy to download and install, just pop into Google Play or the App Store. You don’t pay interest with Dave, but there is a $1/month fee to get access to Dave loans.

- Earnin app. For an easy way to get early access to your paycheck consider Earnin, formerly known as ActiveHours. Earnin is compatible with many employers but not all. If you can link Earnin to your timesheet you can easily get access to at least $100 a day without paying interest. Earnin makes its money via voluntary tips. Available on iOS or Android.

- Avant app. Great for larger loans, Avant offers APRs as low as 9.95%, though poorer credit scorers could be looking at up to 35.99%. Avant is a traditional lender so your credit score will be checked when you apply, applications also take a few days to complete. However, you can borrow as much as $35,000 with Avant which is much more than many other apps offer.

- LendUp app. A payday lender, LendUp can get you access to between $100 and $1,000 but the amount depends on the state you live in. In some states, it does not offer loans at all. Loans are expensive, with APRs again varying by state with rates as high as 917% APR not unusual. LendUp is an option if your credit score is poor, and if none of the other apps offer a solution for you.

- LoanSolo app. You don’t need a great credit score to borrow from LoanSolo. Get as much as $2,500 by the next business day with LoanSolo. Applying is straightforward, just complete a quick form on the provider website. The LoanSolo app uses the information you provide to connect you to a suitable lender that can give you a fast decision.

Money app terms

Borrowing with a money app is a financial commitment and knowing what you are agreeing to is important. Understanding the terms used by money apps is a good first step. Here are the most important terms you should know about.

- Your annual percentage rate is the interest you pay on a loan over a yearly period. Consistently comparing interest rates on an annual basis is important as interest rates can appear to be low when quoted on a daily or monthly basis, when in fact the rates may be comparatively high. Note that some apps charge no interest.

- Loan amount. The total amount you are borrowing is also called the loan principal or loan size. This is the amount you receive in your bank account. Your total repayments will often be higher than your loan amount due to interest and other charges.

- Loan term. The term of your loan is the repayment period, your loan will be repaid at the end of the term unless you extend the loan. Money apps can feature short loan terms of days and weeks but most loans are measured in months or years.

- Late charge. Also known as a missed payment charge, this is the amount you will be charged if you do not make a scheduled payment on time. Lenders charge this to discourage borrowers from missing payments and to compensate the lender for processing costs.

- Credit score. Your credit score is based on your previous borrowing history. This includes your track record for making payments on time and for fully repaying loans. Lenders use your credit score to decide whether lending to you presents a high risk. Many money apps will consider borrowers with poor credit scores.

How to pick an app

Too many choices? Start by thinking how much you need to borrow. If you need more than $500 you can immediately rule out many of the latest apps including MoneyLion and Dave.

Next, consider what your personal credit score is. If you have a poor credit history you need to keep in mind that many lenders will refuse to lend to you. Yet some, such as MoneyLion, will lend you money without ever referring to your credit file.

Finally, consider what other users are saying about a specific borrow money app. A low app store score does not necessarily mean you will experience similar frustrations. Read our review summary and if you’re still not sure check the individual app reviews in the app store to get a better picture.

Disclaimer:* Chime SpotMe is an optional, no fee service that requires $500 in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $100 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. SpotMe won't cover non-debit card purchases, including ATM withdrawals, ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. Click here to check out SpotMe terms.** Early access to direct deposit funds depends on timing of payer’s submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the payer’s scheduled payment date.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

| Pros | Cons |

| No interest or fees and tips are optional | Eligibility is limited based on how you’re paid or what kind of job you have |

| Balance Shield can help prevent overdrafts from your bank account | You sacrifice some privacy |

| Available for both Android and Apple users | Low withdrawal limits |

What you need to know about the Earnin app

Earnin is an app that, similar to a payday loan, lets you use your next paycheck as collateral to get money the same day. Earnin works by automatically deducting the amount you borrow from your checking account on your next payday. If you’re thinking about using the app to get cash before you get paid again, here are a few things to consider.

Eligibility is limited

To use the app, you must have direct deposit to a checking account set up through your employer, have a consistent pay period — weekly, biweekly, semi-monthly, monthly — and either work at the same location each day or use online timesheets to track your hours.

Your rate of pay based on the amount deposited to your account — meaning after taxes and other deductions have been deducted from your paycheck — must be at least $4 an hour. Unemployment, Supplemental Security Income and disability payments are not included in Earnin’s calculation.

Earnin calculates your take-home pay rate based on the money that’s direct deposited into your bank account from a single employer and your work schedule. If you earn commissions, tips or have a side gig, that additional income can’t currently be included in your earnings. One notable exception is that Uber and Earnin have a partnership that allows drivers to use the app.

You sacrifice some privacy

To set up your Earnin account, you must provide your bank account number and routing information to link the app to your checking account.

After your account is set up, you must either upload copies of your timesheets or enroll in Automagic Earnings to have Earnin track your hours automatically, using your phone’s GPS to determine when you’re at work.

Low withdrawal limits

The first time you use the app, you can borrow only up to $100 during your pay cycle. But with repeated use, Earnin may adjust your withdrawal limits up to $500 based on how you use the app, your spending habits, what bank you have and whether your employer works directly with Earnin.

If you borrow the maximum allowed amount, you can’t get more money until your next pay cycle begins.

True Money Earning Apps

If you only want a small loan, Earnin’s low withdrawal limits can help prevent you from borrowing more than you need. But if you’re looking for a larger loan amount, Earnin probably isn’t your best bet.

No interest or fees

Earnin says you won’t pay interest or fees when you borrow money using the Earnin app. Instead, the company does encourage users to “tip” an amount they feel is appropriate for using the service. But tips aren’t required to use the app.

A closer look at the Earnin app

If you’re considering using the Earnin app to get a cash advance on your next paycheck, here are a few more things to know.

- iOS and Android: The Earnin app is available for both Apple and Android users.

- Waiting period: It can take up to 72 hours to activate your account after you sign up.

- Direct deposit minimums: You must have a minimum of two direct deposits totaling at least $100 into your checking account to start borrowing money through Earnin.

- Lightning Speed feature: This tool gives you access to your money the same day you request it. So if you’re not signed up for Lightning Speed, you may not receive your money until the next business day. And Lightning Speed isn’t available at all banks.

- Overdraft protection: Earnin could help you avoid overdraft fees when you sign up for the Balance Shield feature, which lets you know when your bank balance is getting low. You may also choose to have amounts of up to $100 automatically transferred to your checking account to prevent overdrawing your account.

Who the Earnin app is good for

Earnin may be a good choice if you occasionally need a small amount of extra cash before your next paycheck and you meet the app’s eligibility requirements.

But continually borrowing against your future earnings isn’t a sustainable financial practice. If you repeatedly use the Earnin app as an alternative to a payday loan, it may be better to review your overall financial situation and make some changes to improve your financial health.

Money Earning Apps For Android

How to set up an Earnin account

Money Earning Apps For Android

To sign up for Earnin, first download the app on your Android device or iPhone. Then follow the prompts to set up your account. You’ll need to provide the following information:

Money Earning App Download

- Email address

- Password

- Paycheck information

- Bank name

- Bank account information

- Employer information

True Money Earning Apps Reviews

Not sure if the Earnin app is right for you? Consider these alternatives.

What Are The Best Money Earning Apps

- TD Bank: A personal loan from TD Bank could be a good choice if you’re looking for a larger loan amount.

- Prosper: Prosper might be a good option for people who don’t meet Earnin’s eligibility requirements. Read our Prosper personal loan review to learn more.