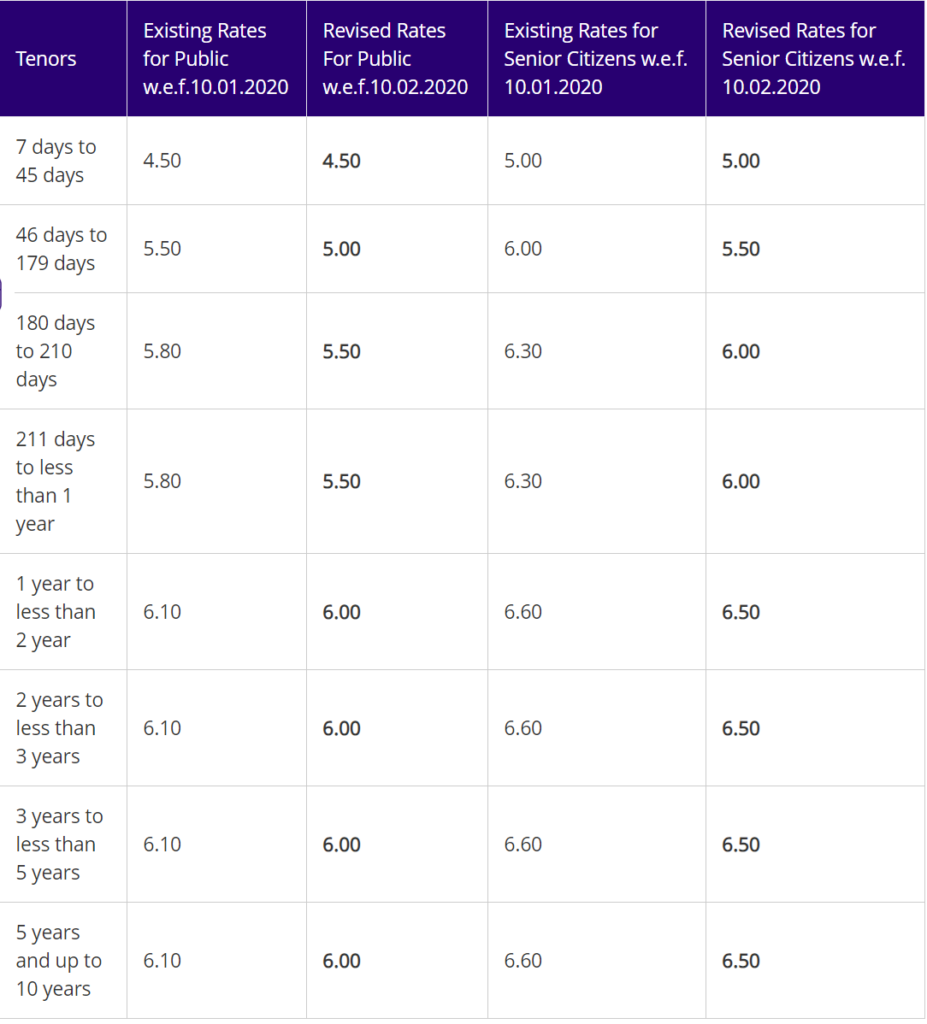

Recurring Deposit Interest Rates

A Recurring Deposit, commonly known as RD, is a unique term-deposit that is offered byShriram City Union Finance Ltd. Recurring deposits enable you make regular deposits and earnbest in segment returns on the investment. Due to the regular deposit factor and an interestcomponent, it often provides flexibility and ease of investments to investors. Similar toFixed deposits, Recurring Deposits are also a contract between you and the Shriram City forthe approved interest rate from the date of investment till maturity.

Recurring Deposit Interest Rates In India

Recurring Deposit Interest Rates

_(1)_1556276231998.png)

However, unlike Fixed Deposit in Recurring Deposits you invest amount on regular intervalsunlike one-time investment in Fixed Deposit. Shriram City comes with about 45 years ofunchallenged trust in the Indian market, with over 5 million trusted customer base acrossthe length and breadth of the nation. With investment tenure ranging from 12 months to 60months, Shriram City's RecurringDeposits come with a 'MAA+/ with Stable Outlook' rating byICRA (Indicates high credit quality). However, it is essential to know that Shriram CityRecurring Deposits are different from Shriram City Fixed Deposits. RDs are flexible in mostaspects. An RD account holder can choose to invest a fixed amount each month while earningdecent interest on the amount similar to SIP’s (Systematic Investment Plans). RDs are anideal saving-cum-investment instrument which encourages wealth building habits toindividuals.

Recurring Deposit (RDs) are very popular investment instruments which allows you to invest a small amount of money and earn interest on it. The investments must be made at regular intervals. Almost all banks across the country offer RDs at attractive interest rates. Various banks and third-party. The base rate is the rate applicable to Retail Fixed Deposits as on the date of booking the deposit. For Recurring Deposits, the interest on Deposits is compounded at quarterly intervals, at the applicable rates. The interest will be calculated from the date the instalment is paid. The Recurring Deposit. Recurring Deposit Calculator Plan your Savings. Find out how much you can save by making regular monthly deposits with our Recurring Deposit plan. Just key in the amount you want to save and the tenure you wish to invest for. The RD calculator will give you total savings for the set interest rate. Interest Rates - Find the rate of interest for savings account, fixed deposits, recurring deposits, iWish RD, NRO term deposits & NRE term deposits.